Did you know that over 95% of personal injury cases are settled before trial – yet the average timeline for injury compensation can range from several months to a few years? Navigating the journey to compensation after an injury can feel overwhelming. If you're hoping for a quick resolution, it’s vital to understand what can speed up or delay your payment after a personal injury case. This comprehensive guide breaks down each phase of the timeline for injury compensation, empowers you with actionable tips, and reveals what you can do to help get paid sooner.

- In this article, you'll learn the phases of the timeline for injury compensation, what affects each milestone, and actionable steps to streamline your personal injury claim.

"Every injury case is unique, but understanding the steps and determinants of the timeline for injury compensation can empower you toward a faster, fair outcome."

A Surprising Look at the Timeline for Injury Compensation and Why Settlement Times Vary

The timeline for injury compensation is shaped by a complex mix of legal procedures, case-specific details, and the actions of both you and the opposing parties. While some injury law claims wrap up within months, others may extend into years—especially when injury cases involve disputes over fault, significant medical treatment, or hesitancy from the insurance company. This unpredictability often surprises injury victims, which is why understanding the steps involved is so crucial.

For example, a straightforward car accident with clear evidence and documented medical records can quickly reach a fair settlement, perhaps within six months. Conversely, a personal injury lawsuit in medical malpractice or product liability might take years due to expert testimony, multiple reviews of injury claims, and complex injury laws. By breaking down the timeline for injury compensation into distinct phases, you can anticipate delays and take control of your case's progress—potentially shaving months off your wait for payment.

Remember, every personal injury case is unique. Being informed about the process allows you to work closely with your injury lawyer or personal injury attorney to set realistic expectations and discover avenues to expedite your claim. By proactively managing documentation, communication, and decision-making, you’re better positioned for a timely and fair settlement.

Understanding the Timeline for Injury Compensation in Personal Injury Law

When you file a personal injury claim under injury law, your timeline will follow several standard steps regardless of whether you're dealing with a car accident, slip-and-fall, or other injury cases. Awareness of the "timeline of a personal injury lawsuit" arms you with knowledge so you can make strategic choices and avoid unnecessary delays. It's crucial to note that timelines can fluctuate depending on whether the injury case is settled pre-trial or progresses to a courtroom battle.

Personal injury laws regulate the process, ensuring fair play but also introducing waiting periods and court-imposed schedules. The injury lawyer or injury attorney you choose plays an essential role in progressing through these stages efficiently. By familiarizing yourself with the main phases—from the incident to investigation, negotiations, and finally, payout—you’ll know exactly where your case stands and what happens next.

The goal is to move efficiently from incident to settlement, minimizing roadblocks. Let's delve deeper into each stage, so you can master the timeline for injury compensation in your personal injury case.

Key Stages in the Timeline of a Personal Injury Lawsuit

- Incident and medical treatment

- Hiring an injury lawyer or personal injury attorney

- Investigation and gathering evidence

- Filing a personal injury claim or injury lawsuit

- Settlement negotiations (with the insurance company or opposing party)

- Personal injury settlement or trial

Filing a Personal Injury Claim: The Start of the Timeline for Injury Compensation

Filing a personal injury claim signals the official start of your journey toward compensation. Most personal injury cases begin with reporting the incident, assessing the extent of the injury, and starting medical treatment. Promptly initiating your claim with the insurance company or against the responsible party is essential, as delays can affect your eligibility due to statutes of limitations governed by injury laws.

Working with an injury lawyer immediately after your incident not only protects your rights but also ensures professional documentation, timely filing, and maximizes the chances of a swift resolution. The longer you wait to file, the more likely it is that crucial evidence will be lost or memories fade—potentially compromising your injury case. Whether it’s a car accident or premises liability injury, act fast to get your claim underway and set a more predictable timeline for injury compensation.

Upon filing, the defendant and their insurance company are legally obligated to respond. Their level of cooperation—or resistance—is one of the earliest clues to potential delays and helps your injury lawyer forecast the process ahead. Carefully crafted claim documents set the stage for negotiations or, if necessary, a full-fledged injury lawsuit.

How Injury Laws and Injury Law Affect Your Claim

Injury laws are the rulebook for how personal injury cases are handled. These laws define who’s at fault, what damages can be recovered, and—for each state—what deadlines and procedures apply (such as the statute of limitations). Personal injury law may also dictate whether comparative or contributory negligence standards apply, impacting how much compensation is ultimately recoverable.

These regulations ensure that every injury case is handled with due process, but they can also slow things down. For example, a requirement for all medical treatment to be completed before calculating damages can extend your timeline for injury compensation. Getting legal advice from an experienced personal injury attorney who fully understands local injury laws will help you avoid pitfalls and move through your claim efficiently.

If you’re unsure which laws apply to your unique injury case, an early consultation with an injury lawyer can clarify these variables and prevent frustrating delays down the road.

Documenting Your Injury Case: Why Accurate Records Shorten the Timeline

Perfect documentation is your secret weapon for accelerating the timeline for injury compensation. Keeping organized and thorough medical records , receipts, accident scene photos, witness accounts, and communication logs provides irrefutable proof that’s hard for insurance companies or opposing attorneys to challenge. Missing paperwork—or inconsistencies—invite drawn-out investigations and repeated requests for more information.

Personal injury lawyers strongly advise starting a dedicated file as soon as possible. Every doctor’s visit, medication, lost wage receipt, and correspondence with medical providers should be included. Not only does this reduce waiting time during the investigation, but it also strengthens your negotiating position at settlement. Quick, accurate responses from you and your injury lawyer are vital in keeping the case moving forward and satisfying tight procedural deadlines under personal injury laws.

Consider leveraging technology for cloud-based organization, too. An organized file can mean the difference between compensation in months rather than years.

Role of Medical Treatment in Fast-Tracking Your Personal Injury Claims

Timely and consistent medical treatment is critical for both your recovery and the timeline for compensation. Insurance companies—and courts—require clear proof that your injuries result directly from the incident. They often demand documentation that you reached maximum medical improvement before proceeding with settlement talks. Delaying or skipping treatment can undermine not just your health, but also your injury case’s credibility and value.

Personal injury laws generally won’t let you settle until you’ve finished or stabilized your treatment so a full accounting of present and future losses can be calculated. Completing care and following every provider’s recommendation ensures all damages (including future pain and suffering) are accounted for in the injury claim, accelerating the path to settlement. Coordinated efforts between your healthcare providers and injury lawyer can streamline evidence gathering and avoid unnecessary pauses in your case timeline.

Remember: Every missed appointment gives the insurance company ammunition to argue that your injury isn’t as severe as claimed. Follow your treatment plan from day one for the fastest and fairest outcome.

How Legal Processes Influence the Timeline for Injury Compensation

Once a personal injury claim progresses to the next phase—such as filing an injury lawsuit—the legal process introduces several stages each with its own timeline. Pre-trial procedures, negotiations, and judicial scheduling come into play, all regulated by local personal injury laws . Understanding how each step unfolds helps set better expectations for how long your injury case might realistically take.

The legal process often introduces pauses for discovery, evidence review, expert depositions, and court-mandated mediation—all standard in personal injury law. Working with proactive injury lawyers ensures procedural steps are completed efficiently, reducing the risk of administrative or technical delays. Your personal injury attorney should advise you of these stages upfront, so you can mentally prepare for the potential length of the process.

Choosing experienced personal injury lawyers who know how to keep a case on track is one of the most effective ways to expedite a fair settlement within the average timeline for injury compensation.

Filing an Injury Lawsuit: Steps and Expected Timelines

The moment you file a formal injury lawsuit , you enter the structured system of the courts. This process begins with a complaint served to the defendant, who then has a set timeframe (often 20–30 days) to answer. From there, both sides embark on "discovery," a process of exchanging documents and evidence, which can take months—sometimes over a year—depending on the case complexity and court docket congestion.

In some personal injury cases, the legal process includes pre-trial conferences, mandatory mediation, and motions to resolve evidence disputes or dismiss the claim. Deadlines for each stage are typically dictated by local courts but can be affected by requests for extensions or unforeseen complications. Statute of limitations deadlines under injury law also mean you must file by a certain date, or your claim may be barred.

Ask your injury lawyer for a stage-by-stage breakdown of expected timeframes, so you’ll know what to anticipate after filing a lawsuit. The clearer your roadmap, the less stressful the waiting period.

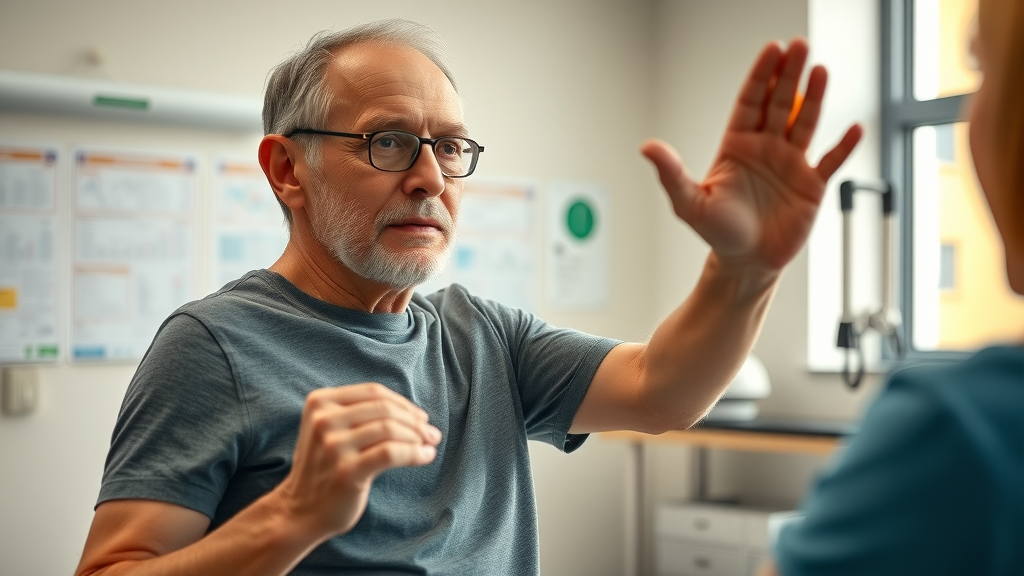

The Role of an Injury Lawyer or Personal Injury Attorney in Your Timeline

An experienced injury lawyer or personal injury attorney is often the catalyst for a faster settlement time. Not only do they interpret injury laws and identify all possible avenues for compensation, but they also handle communication, evidence collection, legal motions, and negotiations. Their expertise is especially important when going up against powerful insurance company lawyers who deploy tactics to stall or minimize payments.

Prompt responses to all inquiries, rigorous evidence collection, and skillful handling of procedural steps by your chosen attorney directly impact the timeline of your personal injury case. The best personal injury lawyers anticipate potential disputes before they arise, advocate assertively for your interests, and cut weeks—or months—from the typical wait for compensation. Selecting a reputable law firm is not just about legal knowledge but about efficiency and aggressive representation under personal injury law.

Personal Injury Laws and Pre-Trial Procedures: What To Expect

Pre-trial procedures in a personal injury lawsuit involve exchanges of evidence (discovery), witness interviews, medical examinations by independent experts, and sometimes pre-trial mediation. These steps are key to clarifying the facts and can lay the groundwork for a settlement—or make a trial inevitable. The complexity and length of these procedures are governed by personal injury laws and local court rules, so timelines can range from months to much longer.

Your injury lawyer will guide you through each requirement and use these milestones as leverage for settlement negotiations. Some cases resolve in mediation, which can shorten the process considerably; others require resolving procedural motions and setting a firm trial date to bring the insurance company to the table. Staying responsive and compliant with these pre-trial steps is imperative to avoid unnecessary delays.

Understanding each requirement, keeping communication open with your legal team, and submitting documentation on time are essential to keep your case on a forward trajectory during this part of the timeline for injury compensation.

Injury Settlement Negotiations: Factors That Accelerate or Delay Your Compensation

Settlement negotiations are among the most unpredictable stages in the timeline for injury compensation. Insurance companies often start with a low offer, testing whether you’ll settle quickly or resist for a higher payout. Your injury lawyer’s negotiation skills are your frontline defense here—they analyze the offer, present counter-evidence, and push for a resolution that reflects the true value of your personal injury claim.

Delays occur when there’s disputed liability, incomplete medical records, or ongoing medical treatment that prevents a final calculation of damages. Sometimes, only the threat of a trial—signaled by filing a lawsuit—forces the insurance company to negotiate fairly. Transparent communication with your attorney and a willingness to provide additional evidence as needed will help keep negotiations moving and avoid unnecessary standstills.

Ultimately, being realistic about your settlement demand, while remaining persistent and well-documented, is the best way to bridge the gap and reach resolution within a reasonable timeframe.

Factors Impacting the Timeline for Injury Compensation in Injury Claims

The timeline for injury compensation in any personal injury law case depends on an interplay of multiple case-specific variables. These include the medical complexity of your injuries, the availability and clarity of evidence, responsiveness of insurance company representatives, as well as the sophistication of your legal team. Understanding these factors puts the power in your hands to anticipate delays and employ strategies—recommended by injury lawyers—to overcome them.

Every phase in your injury case—from reaching maximum medical improvement to gathering documents—either brings you closer to a fair settlement or creates the possibility of added wait time. Let’s break down the most significant contributors to fluctuating timelines across injury claims.

By identifying what can slow your progress, you’ll know where to focus your efforts for a faster, smoother experience.

Severity of Personal Injury and Recovery Duration

The more severe your personal injury , the longer it usually takes to reach a settlement. In cases with catastrophic injuries or those requiring multiple surgeries, doctors must wait until you've reached maximum medical improvement (MMI) to estimate total costs and future care needs. Only then can your personal injury lawyer accurately value your claim, negotiate with the insurance company, and push for fair compensation.

Conversely, minor injuries that resolve quickly may allow settlement in a matter of months, because fewer variables must be accounted for. Delaying too long post-recovery, however, risks evidence fading or insurance company reluctance. It’s a balancing act: settle too early, and you may undercut your long-term needs; wait too long, and administrative or legal burdens may intensify. The best approach is to communicate closely with your injury attorney while advancing your recovery as efficiently as possible.

Investigating Injury Claims: Evidence, Witnesses, and Liability

Detailed investigations are vital in injury claims where liability is unclear or highly contested—such as multi-car accident cases or slips and falls in public places. Thorough evidence gathering, from accident scene photos and medical records to eyewitness statements and expert opinions, forms the backbone of a compelling personal injury case. Delays are most common when information is missing, or witnesses are uncooperative or hard to locate.

Your injury lawyer or attorney leads this process, but proactive help from you—such as providing lists of witnesses or tracking down surveillance footage—can accelerate progress. The insurance company often uses any lack of clarity to stall or devalue your injury claim, so strong evidence and organized documentation are critical to prompt case resolution. Invest the time early to get your evidence ducks in a row; it pays dividends by reducing the timeline for injury compensation.

Stick to this mantra: every piece of evidence you produce early puts you a step ahead in injury law negotiations and litigation.

Insurance Company Tactics and How They Affect Settlement Time

Insurance companies are notorious for deploying strategies designed to slow down the settlement time . Common tactics include requesting redundant documents, requiring independent medical examinations, disputing medical causation, or rotating adjusters to “reset” negotiations. Their ultimate goal is often to pressure you into accepting a lower settlement or abandoning your personal injury claim entirely.

Expert injury lawyers counter these stalls by vigilantly following up, documenting every communication, and threatening litigation at key moments. Some insurance company adjusters may also drag their feet in cases involving high-value injuries—waiting until maximum medical improvement is reached, or banking on claimants’ financial desperation to force a hasty (often unfair) settlement. Patience and tenacity paired with strong evidence are your biggest allies here.

Be aware: never sign anything or accept a check from the insurance company until you’ve reviewed all options with your injury lawyer to ensure your fair settlement is protected.

Complexity of Car Accident and Other Cases

Claims arising from multi-vehicle car accidents , product defects, or medical malpractice commonly involve multi-layered investigations, numerous parties, and intricate expert testimony. The timeline for injury compensation in these cases typically extends far beyond the average for more simple incidents. Factors that complicate your case include ambiguous liability, multiple at-fault parties, pre-existing health conditions, or litigation involving minors.

In complex cases, litigation can last years as legal teams gather specialized evidence, schedule depositions, and wait for court dates. For example, a car accident with disputed liability or a defective-product case may drag on as both sides produce medical records, expert analysis, and forensic data. Consulting experienced personal injury lawyers at the very start helps manage these complexities and can sometimes facilitate faster interim settlements or partial payments to cover immediate expenses.

Communicate frequently and follow your legal team's instructions to keep your complex injury claim on track and reduce unnecessary delays.

Achieving a Fair Settlement: What Influences When You Get Paid

Securing a fair settlement depends not only on the merits of your personal injury case but also on the negotiation prowess of your personal injury lawyers. Factors like the quality of documentation, medical clarity, your persistence, and insurance company conduct all impact how quickly and completely you receive compensation. Understanding these variables is the best way to realistically shape your timeline for injury compensation.

With a strategic approach—guided by experienced personal injury attorneys—you can maximize the value of your settlement while minimizing avoidable wait periods. It’s a delicate balance of fast-tracking your injury claims without sacrificing the full value to which you’re entitled by personal injury law.

Let’s look at what your legal team can do to get you paid sooner (and what you can help with, too).

How Personal Injury Lawyers Secure Faster Settlements

Personal injury lawyers use proven negotiation tactics, extensive legal knowledge, and a well-documented case file to apply pressure at each stage. By sending a detailed demand package with complete medical records and accident evidence, they demonstrate to the insurance company that delays will not wear you down. They’re also adept at anticipating defense tactics, heading off disputes, and leveraging alternative dispute resolution (ADR) measures before trial.

Frequent, proactive communication between lawyer and client further minimizes confusion, ensures deadlines are met, and keeps your injury case top-of-mind for adjusters. Well-prepared lawyers can even secure advances or partial settlements for urgent medical or living expenses in more protracted injury claims, keeping timelines reasonable while final negotiations unfold. Choosing a respected legal team means faster, more consistent responses from insurers and, ultimately, a shorter wait for your compensation.

Ask injury lawyers about their typical settlement time frame—and the steps they take to push injury cases forward without sacrificing value.

Calculating Compensation in a Personal Injury Case

Determining your payout involves tallying medical bills, lost wages, cost of future care, and non-economic damages like pain and suffering. Insurance companies use various formulas and multipliers, often offering less than your full entitlement. Your personal injury lawyer or attorney fights for consideration of all medical treatment, future impairment, and long-term impacts. Thorough documentation and accurate calculations form the backbone of settlement negotiations and can dramatically affect both the timeline and the amount of your injury settlement.

Be transparent with your lawyer about all expenses and symptoms, even new or ongoing ones, so your legal team can present a complete, accurate claim. A clear, defensible number pushes the process along more efficiently and reduces the risk of lengthy disputes over injury law calculations.

Personal Injury Settlement: Lump Sum vs. Structured Payments

Once your settlement is achieved, you’ll typically have a choice between receiving your injury compensation as a single lump sum or through structured periodic payments. Both options have advantages; lump sums offer immediate financial relief to pay for outstanding medical bills and lost wages, while structured payments provide long-term stability for serious injuries requiring ongoing care or therapy.

Your personal injury attorney will break down the pros and cons of each option—sometimes negotiating for a mix of both, especially in severe injury cases. While negotiating payment terms may add a brief delay, proper planning ensures your settlement matches your unique needs.

Always consider your long-term interests and consult financial experts if your settlement is substantial or includes structured options.

Negotiations with the Insurance Company and Setting Realistic Expectations

It’s essential to set informed expectations about your timeline for injury compensation. Experienced personal injury lawyers will help you develop a settlement target that reflects the true value of your damages, but remain prepared for counteroffers and sticking points from the insurance company. Recognize that “reasonable” doesn’t always mean “fast”—achieving what you deserve sometimes requires persistence and patience through several negotiation rounds or even courtroom escalation.

Open communication and flexibility (without sacrificing what’s fair) will carry you through. Rely on your lawyer’s experience with similar injury cases, stay realistic about what is possible, and measure each step forward as an important milestone. Ultimately, a fair settlement is one that fully accounts for all your losses while respecting the factual and legal realities of your personal injury case.

Average Timeline for Injury Compensation Across Different Types of Personal Injury Cases

| Type of Case | Typical Timeline |

|---|---|

| Car accident | 6 months – 1 year |

| Premises liability | 8 months – 2 years |

| Work-related injury | 3 months – 1.5 years |

| Medical malpractice | 1 – 3 years |

| Product liability | 1 – 4 years |

- Car accident

- Premises liability

- Work-related injury

- Medical malpractice

- Product liability – with typical timeframes

Navigating Delays in the Timeline for Injury Compensation and How to Prevent Them

Delays are a frustrating reality in many personal injury claims, with causes ranging from waiting on medical treatment to unresponsive defendants. The best antidote to delay is proactivity—by you and your legal team. Keeping your documentation current, complying with injury law deadlines, and being available for key meetings or statements keeps your claim from languishing in the system.

Let’s examine the most common reasons for delays—and how you can help your personal injury lawyer keep your case moving.

"Preparation and persistence are key – the more proactive you and your personal injury lawyer, the sooner your injury claim can be resolved."

Common Reasons for Delays in Personal Injury Lawsuits

Some common reasons your personal injury case may stall include disputes over liability or the need for additional medical evaluations. Challenges arise when the insurance company disputes whether medical treatment is related to the incident or drags its feet responding to evidence produced by your injury lawyers. If you reach a settlement but have outstanding medical bills or liens, a portion of your compensation may be held back until these details are settled.

Other contributors to slowdowns include dense court calendars, delays in obtaining accident reports or expert opinions, errors in claim documentation, or changing legal representation mid-process. The clearer and stronger your paperwork at every stage, the less likely extensive reviews or corrections will be necessary later.

Be mindful: delays are not always avoidable but can often be minimized by staying engaged in the process and partnering with a diligent legal team.

How to Expedite Your Injury Case: Proven Strategies from Top Injury Lawyers

Top personal injury lawyers prioritize speed and organization from day one. They keep your file complete, respond instantly to requests, and schedule medical evaluations promptly. If necessary, they push the insurance company by swiftly filing a lawsuit, showing a willingness to take the case to trial if fair settlement offers aren’t forthcoming. Their resources and reputation often motivate insurers to negotiate more promptly and avoid public litigation.

You can facilitate the process by being reachable, providing documentation quickly, and strictly following all instructions from your attorney. Keeping your medical treatment consistent, honoring all appointments, and promptly reporting new developments also boost both the speed and strength of your claim. If you sense your case has stalled, ask your injury lawyer about possible steps to re-energize the process or escalate to a more advanced negotiation or litigation stage.

Stay proactive: regularly check in with your legal team, keep your injury case organized, and push for consistent updates to maintain momentum.

Practical Steps to Shorten the Timeline for Injury Compensation

- Gather comprehensive documentation early

- Seek prompt and complete medical treatment

- Maintain open communication with your personal injury attorney

- Be mindful of deadlines and statutes under personal injury laws

People Also Ask: Timelines & Settlements in Injury Law

How long do most personal injury settlements take?

- Most personal injury settlements are completed between 6 and 18 months, but the timeline for injury compensation can be shorter or longer depending on case complexity and responsiveness of involved parties.

What is a typical amount of pain and suffering?

- Pain and suffering compensation varies widely, typically ranging from 1.5 to 5 times the direct medical costs in a personal injury claim, subject to injury severity, impact, and jurisdiction.

What is the timeline for settlement offer?

- A settlement offer is usually made one to three months after submitting all injury claims documentation, but complex injury lawsuits can draw this out.

What is a reasonable settlement offer?

- A reasonable settlement offer should cover your financial losses, pain and suffering, medical expenses, and anticipated recovery time as determined with your personal injury lawyer.

Frequently Asked Questions on the Timeline for Injury Compensation

- Can I speed up the timeline for my personal injury case? – Yes, by providing thorough documentation, keeping in touch with your injury lawyer, and following all legal and medical recommendations, you can often accelerate your case.

- What if the insurance company delays my claim? – Have your lawyer document all communications and consider legal escalation if delays become unreasonable. Sometimes filing a lawsuit pushes insurers to settle faster.

- Do all injury cases go to trial? – No, most personal injury claims settle out of court, but being prepared for trial can expedite negotiations and encourage fair offers.

- How does hiring an injury attorney impact my settlement time? – The right lawyer can dramatically shorten your timeline for injury compensation by managing paperwork, communications, and negotiations efficiently.

Case Examples: Real Timelines for Injury Compensation in Personal Injury Cases

- Rapid settlement for a car accident injury case: A straightforward rear-end car accident with prompt medical treatment and clear liability was settled in just four months after claim filing, with minimal negotiation.

- Extended negotiation in a medical malpractice injury lawsuit: This complex case required 20 months due to lengthy medical reviews and contested liability, but thorough documentation and persistence secured a fair settlement.

- Typical duration for a slip-and-fall personal injury claim: Most slip-and-fall claims with moderate injuries resolve in 8–14 months, often hinging on timely completed medical records and witness statements.

Checklist: How to Stay on Top of Your Timeline for Injury Compensation

- Track all personal injury lawsuit milestones

- Communicate frequently with your injury lawyer

- Organize your injury claim documents

- Follow medical advice carefully

Actionable Advice: Partnering with an Injury Lawyer for the Best Outcome

- How to choose a reputable personal injury lawyer: Look for proven results, transparent communication, and deep experience in personal injury law.

- Key questions to ask about your timeline for injury compensation: Inquire about average settlement times, challenges in your case, and strategies to expedite resolution.

- Benefits of expertise in personal injury law and personal injury settlement: Expert lawyers optimize both the timeline and payout, handle negotiations, and prevent common pitfalls unique to injury law.

Summary and Takeaways: Planning Your Timeline for Injury Compensation

- Start early, document thoroughly, seek expert guidance

- Every personal injury case is different, but knowledge and proper action can accelerate the process

- Closely monitor your claim and prioritize clear communication with your personal injury lawyer

Ready to Manage Your Timeline for Injury Compensation?

- Learn more: visit pugetsoundinjurylaw.com/

Take control of your injury claim by staying organized, communicating closely with your injury lawyer, and following key deadlines. Start early for a smoother road to compensation!

Understanding the timeline for injury compensation is crucial for managing expectations and expediting the process. The duration of a personal injury case can vary significantly based on factors such as the severity of the injury, the complexity of the case, and the responsiveness of involved parties.

For instance, in Connecticut, the personal injury claims process typically unfolds as follows:

-

Immediately After the Accident : Report the incident, seek medical attention, and gather evidence.

-

Days to Weeks Later : File an insurance claim promptly, as insurers often have strict deadlines.

-

Three to Six Months After the Accident : Continue medical treatment until reaching maximum medical improvement (MMI). Settlements are often reached during this period.

-

One Year or Longer : If a settlement isn’t achieved, the case may proceed to trial, extending the timeline.

-

At Least Within Two Years of the Accident : Connecticut’s statute of limitations requires filing a claim within two years to preserve the right to compensation. ( jacobs-jacobs.com )

In North Carolina, the workers’ compensation claim timeline includes:

-

Within the First Five Days : The employer files Form 19 with the workers’ compensation insurer, and the employee submits Form 18 to the North Carolina Industrial Commission.

-

Within the First Week : If unable to work for seven days post-injury, the employee becomes eligible for benefits.

-

Within 21 Days : After 21 days of missed work, compensation for the initial seven days may be provided.

-

Within 30 Days : Injuries must be reported to the employer within 30 days to maintain eligibility for benefits.

-

Within 2 Years : Claims must be filed within two years of the injury date. ( vancamplaw.com )

It’s important to note that statutes of limitations vary by jurisdiction. For example, in England and Wales, personal injury claims must be initiated within three years of the accident, with certain exceptions. In the United States, statutes differ by state and injury type, with some states allowing one or two years to file a claim. ( en.wikipedia.org )

Given these variations, consulting with a qualified personal injury attorney familiar with local laws is essential to navigate the claims process effectively and ensure timely compensation.

Add Row

Add Row  Add

Add

Write A Comment